An unidentified woman won a slot machine jackpot of more than $1.5 million early Saturday morning at Chinook Winds Casino Resort.

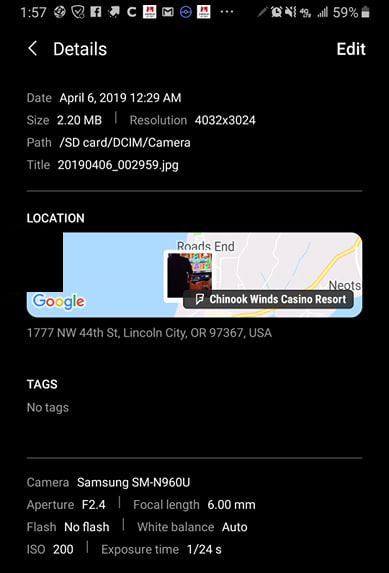

A photo shared with Lincoln City Homepage confirms a progressive slot machine jackpot win of $1,585,455.05 shortly after midnight at the casino, 1777 NW 44th St. in Lincoln City.

According to an eyewitness who wished to remain anonymous, a woman wagered the maximum $3 bet on a Monopoly slot machine and was immediately whisked away by security.

“Somebody’s life just got changed,” the bystander said. “Not mine, but, hopefully, they needed it.”

The image, whose metadata included a digital timestamp and location information verifying that the photo was authentic, shows a gray box with the wording:

Call Attendant

Jackpot Handpay

$1,585,455.05

Chinook Winds staff on duty at 1:30 a.m. said it was unable to comment on the win, stating, “We can neither confirm or deny.”

According to tax calculations, the winner should take home nearly $850,000.

In Oregon, gambling wins under $600 are exempt from income tax. Since it is over that amount, the winner is looking at approximately $155,000 in state taxes.

They will have 25 percent of the jackpot automatically withheld by Chinook Winds to be given to the federal government. That would amount to $396,363.76 and doesn’t cover total taxes owed on the win.

Having joined the highest tax bracket, the winner must pay about 34.56 percent tax, so they will owe 9.56 percent or $151,569 to the feds.

The Federal Insurance Contribution Act (FICA) tax that funds Social Security and Medicare is another 2.74 percent, or $43,419.

The breakdown doesn’t take into consideration filing status or whether the person lives in another state or a number of other factors, but the individual(s) should pocket approximately $839,474 when Oregon and the IRS are done.

| Tax Type | Marginal Tax Rate | Effective Tax Rate | 2018 Taxes* |

| Federal | 37.00% | 34.56% | $547,868 |

| FICA | 2.35% | 2.74% | $43,419 |

| State | 9.90% | 9.76% | $154,695 |

| Total Income Taxes | 47.05% | $745,981 | |

| Income After Taxes | $839,474 | ||

| Retirement Contributions | 0 | ||

| Take-Home Pay | $839,474 |

Source: SmartAsset